With more and more people becoming aware of the potential dangers of the internet, shoppers are becoming warier of what details they submit online and where. Although recent online shopping trends show that this does not hinder people from buying from websites, it does affect what type of website people buy from.

Contents:

- Introduction

- Criteria for Payment Method Selection

- Different Payment Methods

- Choosing the Right Payment Method

- Implementation Recommendations

Introduction

A poor checkout experience will reduce your conversion rate and increase your checkout abandonment. The payment methods you offer and how these are configured will be a major factor in the checkout journey which is affecting your sales right now.

How your site asks for shoppers’ details, including payment information, can affect their likelihood to buy by 30%.

It’s relatively straightforward to avoid the big mistakes made by your competitors. In this article we’ll discuss:

- The different payment methods

- Why they are important

- How you can add them in your ecommerce site

We won’t be recommending the single best payment method but a combination, as 85% of the top-60 grossing US and European e-commerce sites currently offer one or more third-party payment options (Baymard) and there is a reason for this – it increases sales.

Criteria for Payment Method Selection

Before you select your payment methods you need to consider the three main criteria that contribute to the decisions:

Your customers location

Different countries have preferred payment methods and recognized payment brands. Using these will increase your conversion rate through brand recognition. However, having too many payment methods can be confusing and Hick’s Law suggests customers will spend more time considering options and therefore increase the likelihood of not making a decision and leaving.

To avoid this, you can configure your site to offer different payment methods based on the delivery address; that’s a great way to be specific without overcomplicating the checkout for all customers.

Your products

The types of products you sell will massively impact your customers preferred payment methods. For example, a low-value product (especially an impulsive purchase) must have a fast checkout, ideally a single page, and most likely using a digital wallet that doesn’t require a physical card to be entered as this is a barrier.

If you sell high-value goods, offering a buy now pay later payment method will capture more sales and increase your average order value.

Your audience

Your audience should always contribute to the decisions you make; if you build your website for them, you’ll grow.

The best way to manage decisions based on your audience is to ask! Don’t be afraid to ask if you had the right payment method – email them, call them, find where they are online, and post a question there. Speaking with your audience is the best way to better your business.

Keeping the above in mind, let’s explore the most popular different payment methods and benefits.

Different Payment Methods

Credit and Debit Cards

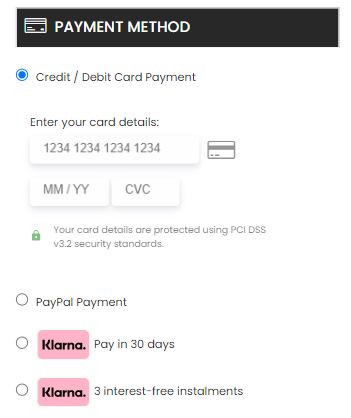

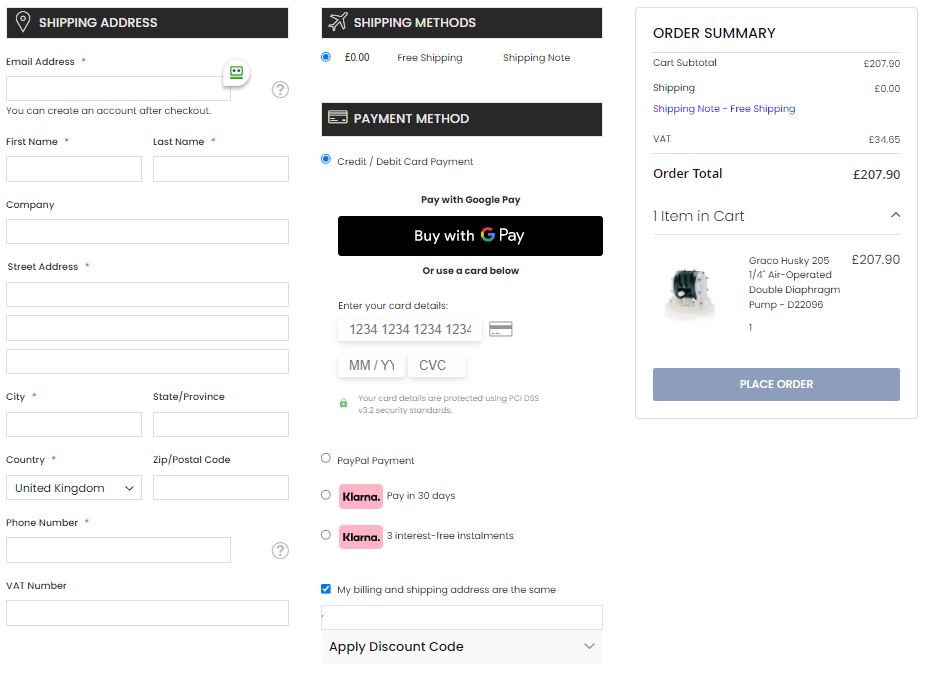

You’ll find that most sites receive the majority of payments through a credit and debit card payment gateway.

One key point about this payment method is to use a payment service provider that has a good quality and reliable service and offers a well-built and managed integration with your ecommerce platform. Without a tight integration that is maintained, you’ll always experience usability issues that will increase abandon cart rates.

We recommend the use of a hosted solution to ensure you comply with PCI DSS. This means that the payment gateway captures card details securely on your behalf and you never actually see the full card details. In addition, you can also use an iframe that will keep your customer on your website and present the card entry fields within your domain and on the checkout pages. It’s still secure and complies but reduces the number of steps in the checkout.

The payment gateway providers that we’ve worked with and would recommend their service and technology, are listed below in no particular order:

- Opayo

- Square

- Stripe

Digital Wallets

The beauty of a digital wallet is that they take 23 digits (your card number, expiry, and CV2) and securely put it behind your thumbprint or your password. The point is, its quick and easy.

Digital wallets speed up the checkout journey and remove multiple barriers, all of which have a positive impact on conversion rate.

Most digital wallets are built for mobile, which is important to consider if you have a higher volume of desktop traffic.

The two main providers in this space are Apple Pay and Google Pay. Neither of these are actually payment gateways as they require a third party to process the payment. When using the right third party, you’ll be able to configure the presentation of Apple Pay and Google Pay to the appropriate audience, i.e. iPhone users or Android – that’s another example of adding multiple payment methods while simplifying the checkout.

Along with Apple Pay and Google Pay, the other main providers in this space are PayPal and Amazon Pay. The difference between PayPal / Amazon Pay and Apple Pay / Google Pay is that the former is both a digital wallet and a payment gateway together – meaning that they process the transaction.

Adding Apple Pay and Google Pay is possible right now through an existing payment gateway. The payment gateway providers that we’ve worked with and would recommend their service and technology, are listed below:

- Square

- Stripe

Buy Now Pay Later

As I mentioned earlier, certain products will benefit more from Buy Now Pay Later, typically when the total cart value is in the hundreds. However, there does seem to be a trend where even lower value purchases are offered with a simple ‘pay in three’ payment option.

A word of warning before you go charging into this. Lots of products on the market are unregulated, for example, Klarna’s Pay in 3 installments and Pay in 30 days agreements are not regulated by the FCA. Although it’s unclear what this may mean for the future, it’s likely that there will be further changes required. There are regulated products on the market that offer credit and these may be more suited to your customers; for example V12 Finance.

The benefit of buy now pay later is huge, you’ll see an increase in conversion rate and an increase in average order value.

There are three providers that we’ve worked with who we would recommend and that is:

- PayPal

- Klarna

- V12 Finance

Bank Transfers

This payment method may seem slightly odd for a lot of UK businesses, but it’s a method that’s widely used and often preferred in European countries. It’s much safer (in terms of chargebacks) for merchants and the merchant rates are insignificant compared to credit and debit cards.

Newer technology has enabled this payment method to be more seamless and easier to manage for both sides of the purchase.

This is less likely to improve your conversion rate compared to the other payment methods, however, you may find it results in attracting more overseas customers.

The providers that we’ve worked with and would recommend their service and technology, are listed below:

- PayPal, using iDEAL

- Non-integrated ‘Bank Transfer’ payment option

Note – Adding iDEAL in the Netherlands can have an uplift in sales of 45%

Choosing the Right Payment Method

Like with a lot of decisions in ecommerce, it should be made based on your business and hopefully, the above information will help you make those decisions.

Based on our experience working with UK SMEs, our recommendation is as follows:

- Credit / Debit cards – Opayo connected with Elavon Merchant Services or Stripe

- Digital Wallet – PayPal & Apple pay / Google Pay through Stripe

- Buy Now Pay Later – Configure Buy Now Pay Later through PayPal or Klarna

- Bank Transfer – iDEAL through PayPal, or Sofort through Klarnam

American Express – Should I accept it?

Why not? Customer lifetime value and referrals are more valuable than the additional merchant cost from American Express.

Implementation Recommendations:

Here are our recommendations for a UK ecommerce business:

- Accept credit and debit cards as the primary payment method.

- Add digital wallets focusing on Apple Pay and Google Pay.

- Only show Apple Pay for iPhone users and Google Pay for Android.

- If your typical order is a single product and you do not have much success in upselling / cross selling, include the Apple Pay and Google Pay buy button on the product page (therefore skipping the standard checkout).

- Always offer PayPal and include the button at the very start of the checkout (and in the cart summary page). Ideally, you want to have a clear indication of shipping cost where ever the PayPal button is – without this you’ll definitely see an increase in abandon carts.

- If you have products in the hundreds of pounds, or your average order value is in the hundreds of pounds, include a buy now pay later offering.

- Which ever payment gateway provider you select, look for an integration with your ecommerce solution that shows fraud results in the orders listing so that your team can quickly highlight potentially fraudulent orders

- Also ensure that the integration has features for refunds and taking additional payments from within the order in your ecommerce platform, as without this it will result in more effort for payment changes and more human error.

Related Ecommerce Insights